To encourage spending in Taiwan, the government introduced a tourist tax refund scheme for travellers holding a non-Taiwanese passport.

Tourists spending over NT$2,000 at designated stores are entitled to a full VAT rebate of 5%.

Click link to go to the appropriate section on this page.

The Taiwanese government have introduced an incentive scheme to attract more tourists. They’re giving handouts of NT$5,000 ($165) to 500,000 tourists from May 2023.

Tax Refund Requirements

- Tax refunds are only available from stores where you see the tax refund logo (above).

Click here for a full list of participating stores - Ensure you have your non-Taiwanese passport on you when making the purchase

- If you needed a Visa to enter the country, you may also need to show them this

- Refunds are eligible for anyone making purchases of NT$2,000 or more from the same store during the same day. You can therefore make multiple smaller purchases from the same store that totals over this amount

- Tax refunds must be claimed within 90 days of making your purchase

Tax Refund Procedures

Procedure at Store

- When purchasing your item(s), ask the shop assistant for the Tax Refund Claim Form

- Show them your passport and they will complete the form, attach the receipts, and ask you to sign it

- Keep this form safe until you leave the country

Note:

There are a few places where you can claim your refund immediately. You simply need to take your goods and passport to the VAT Refund Service Counter at that location to claim your refund (see Locations section).

Procedure at Airport

- Visit the VAT Refund Service Counter or the E-VAT Refund Machine before you check-in your luggage (see Locations section)

- You will need to show them (or scan if using machine) the following

- Tax Refund Claim Form along with receipts

- Passport (and Visa documents if required)

- Purchased goods

- If approved, you can either choose to refund the amount to your credit/debit card, or receive a cheque which you must take to a nearby bank (found within either airport) to exchange it to your desired currency

- You may be required to show your goods at the customs check before you can receive you refund (these are located directly adjacent to the refund booths)

Tax Refund Locations

If the refund desks are not open, you can still make your claim from the refund desks open 24 hours a day at both airports. E-Vat refund machines can be found close to the desks.

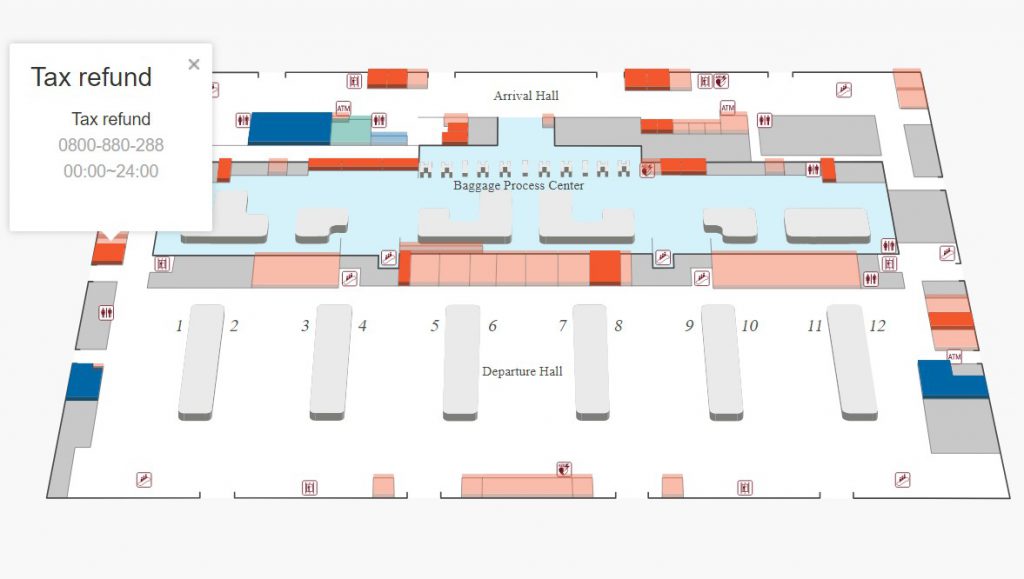

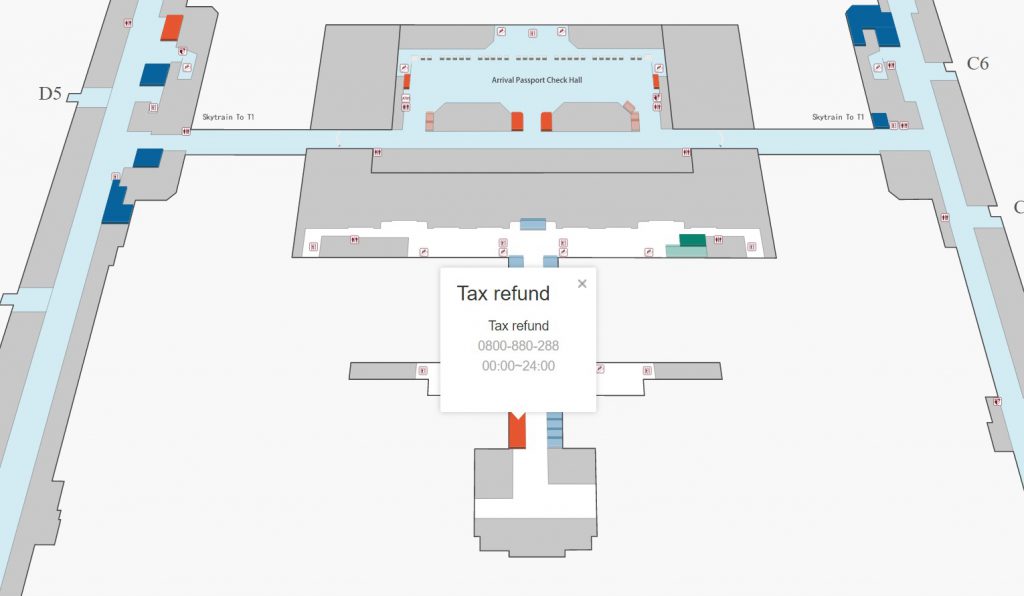

Taoyuan Airport

Terminal 1

Floor 1 between departure and arrivals halls

Terminal 2

Floor 2

Songshan Airport

Found in Terminal 1 on the first floor

Taipei Main Station

There is a tax refund desk located near the Taoyuan Airport MRT station at Taipei Main Station.

This can be found on floor B1, and is right next to the In-Town Check-In Area and a Starbucks.

You will need to use this desk if you want to take advantage of the In-Town Check-In (it will save a lot of hassle at the airport!).

Click here to read more about the In-Town Check-In facility at Taipei Main

I would recommend coming here instead of the airport tax refund desk as it’s normally less busy, plus there is a customs desk right next door should you need to have any of your purchases examined.

Note that there are limits to any refunds you can claim here (see Limits section below).

Klook.comShoppings Malls

The Taipei 101 mall, and all SOGO and Shin Kong Mitsukoshi malls in Taiwan allow you to get an immediate tax refund on any purchased goods.

Only some of these malls have tax refund counters, but you can claim your refund if you have purchased your goods from the another mall of the same brand.

The malls that have tax refund counters are:

| Mall Brand | Branch | Tax Refund Floor |

| Shin Kong Mitsukoshi * | A4 | 3 |

| Shin Kong Mitsukoshi * | A8 | 3 |

| Shin Kong Mitsukoshi * | A9 | B1 |

| Shin Kong Mitsukoshi * | A11 | 3 |

| SOGO | Fuxing | 1 |

| SOGO | Zhongxiao | B2 |

| SOGO | Dunhua | 4 |

| SOGO | Tianmu | 1 |

| Taipei 101 Mall | – | 1 |

* 20% processing fee.

Limits for Shoppings Malls

The following limits apply when claiming a refund from locations other than the airports:

- Purchases from a single store on the same date must be less than NT$48,000

- Total purchases for a single visit must be less than NT$120,000

- Total purchases for multiple visits within the same year must be less than NT$240,000

If your purchases fall outside these limits, you’ll need to use the airport tax refund desks.

Useful Information

- A handling fee of 14% will be taken out of your tax rebate

- Download the Taiwan Tax Refund App (Android / iOS) for information such as nearby tax refund stores, personal refund history and even a calculator

- Tax refunds cannot be claimed for meals or hotel bookings

- Ensure you give yourself enough time if claiming your refund at the airport

- Watch this useful guide on obtaining your tax refund:

If you have found the information on this page helpful, please take a minute to share this post. Your support would be greatly appreciated :)